The recent housing slowdown has given opportunities to buyers that may not be so financially well off. It has even began to give sellers anxiety. However, the price of home listing are not coming down, on the contrary they’re reaching new all time highs as of Spring 2019.

For the first time in March, the median sales price reached $300K. Even though annual price growth has seen a slow down, it’s only in a few parts of the country. Overall the US list price increased 7.2% YoY in March. Comparing it to inflation which went up a mere 1.3%.

Danielle Hale, chief economist of realtor stated that, “Prices are continuing to rise and they’re going to get higher. The same property today that’s for sale is more expensive, and we’re seeing more higher-end homes for sale.”

You’re probably wondering why prices are rising if the market is supposed to be cooling?

“In a slowing market, it’s not uncommon to have a gap between list prices and sale prices. It can take sellers a little bit of time to catch up to the reality,” Hale says.

The market cooling started last summer when the intense home prices began to slow down. This was simply due to supply and demand. Many homeowners saw that home prices were at record high and they tried to capitalize on the opportunity. Ironically, all this did was flood the market with inventory that essentially lowered the prices and slowed down the market. Another factor was the rise of interest rates that got too high for some buyers. These factors ultimately led to price cuts, especially on more expensive homes and the prices didn’t climb as high as the previous year.

In total, there was a 4% increase in the amount of home sale prices for March. However, homes with prices below $200,000 were down 9%. This is making it more difficult for first time home buyers and those with less cash.

The majority of the housing increase came from the luxury market. When it came to homes priced over $750,000, there was an 11% YoY increase in the month of March.

For those that may not have that financial capabilities, there is good news. Mortgage rates have fallen to 4.06% which is giving buyers some relief. It’s the lowest it’s been since January 2018 and well below the 5% in November. This means that if you’re to buy a property for $300,000 you’ll save an average of $100/mo or more in mortgage payments, which can add up in the long-run.

Where are prices rising and falling?

So where are prices going down, rather than up? In the nation’s most expensive market—Silicon Valley’s San Jose, CA, metropolitan area—prices plummeted 12% in March compared with the previous year. But don’t get too excited—homes still cost a median $1.1 million as of March 1, according to realtor.com data.

(The report included only the 50 largest metros, which include the main city and the surrounding suburbs and urban areas.)

“It’s a reflection of the huge influx of homes sitting on the market [in that area],” says Hale. The San Jose–area listings were up 114% in March over the previous year. “There’s more choices for buyers and more competition among sellers.”

Prices were also down 3% in San Francisco, Dallas, Houston, and Jacksonville, FL; 2% in Nashville, TN, and Austin, TX; and 1% in Miami and Orlando, FL.

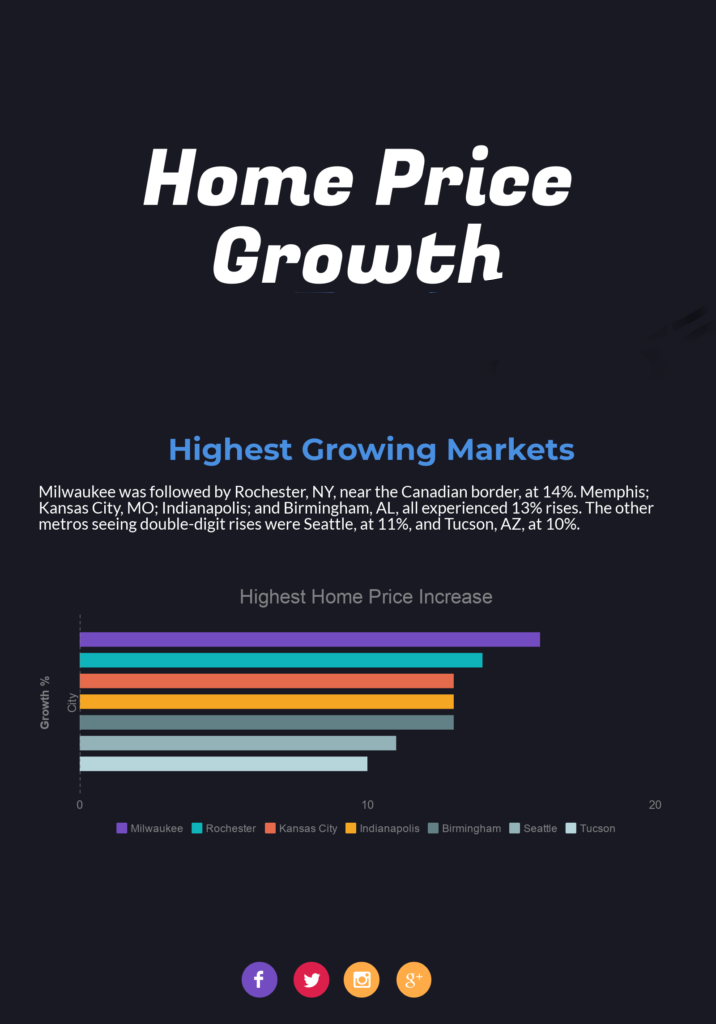

On the other end of the spectrum, Milwaukee saw the biggest jump as median home prices were up 16% year over year in March. That’s likely due to the shortage of properties for sale as listings were down 8% annually. Median prices were $270,000 as of March 1.

“There has been this chronic shortage of homes on the market,” says Milwaukee-based real estate broker Betsy Head of Milwaukee Executive Realty. “People are finally getting to the point where they’ve tried to buy a home a few times and they may have failed because they wanted to negotiate on price. They are figuring out … they have to go in close to asking prices—or over it.”

But the median home price in the Milwaukee area is still reasonable when you look at many other parts of the county.

Milwaukee was followed by Rochester, NY, near the Canadian border, at 14%. Memphis; Kansas City, MO; Indianapolis; and Birmingham, AL, all experienced 13% rises. The other metros seeing double-digit rises were Seattle, at 11%, and Tucson, AZ, at 10%.